Nuclear application in medicine is a long way to go. As early as the end of the 19th century, the theory of using radioactive materials in the medical field had been put forward, but the road of research and development was extremely difficult. It was not until the 1940s that radioisotopes were officially used in clinical practice. China's nuclear medicine started relatively late, especially nuclear medicine, and even experienced a long period of stagnation, with a large gap between Europe and the United States.

Because nuclear medicine involves radioactivity, this variety has become a special existence, and R&D, production and use are strictly controlled, thus forming a high barrier. However, recently, with the approval of a blockbuster nuclear drug, the nuclear drug market has officially ushered in a new participant.

End the era of duopoly

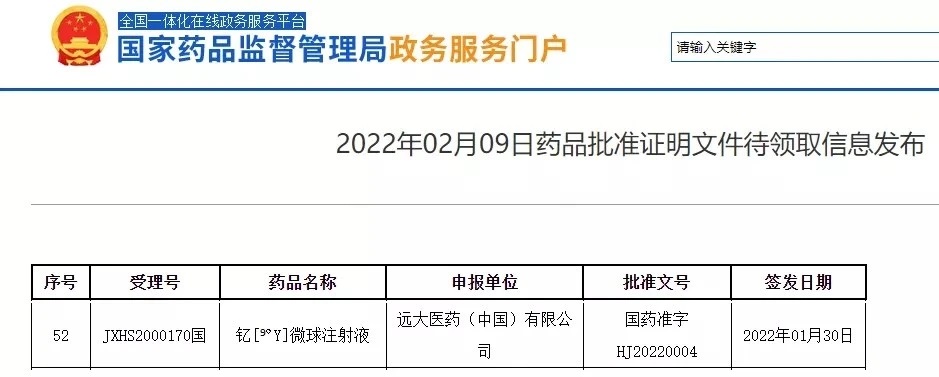

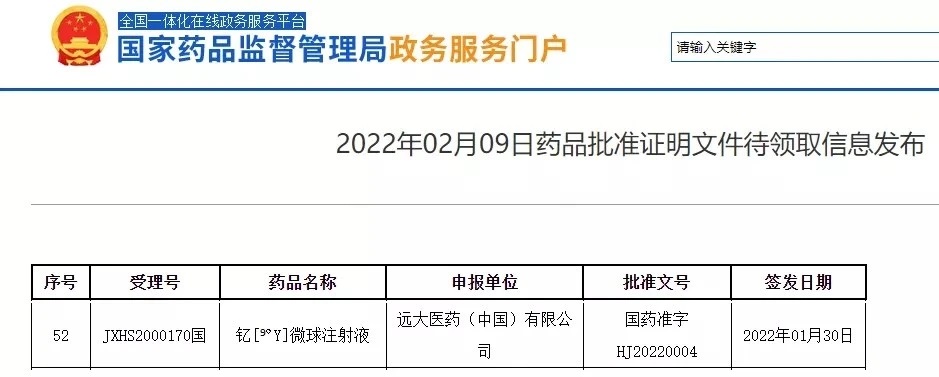

Recently, Yuanda Pharmaceutical announced that its associated company, Sirtex's SIR Spheres yttrium [90Y] microsphere injection, had obtained the drug registration certificate issued by the State Food and Drug Administration. The first indication approved was for the treatment of patients with unresectable colorectal cancer liver metastasis who failed to receive standard treatment.

Source: official website of the State Food and Drug Administration

It is reported that yttrium [90Y] microsphere injection has been approved by FDA and EMA for marketing as early as 2002, and is still the only product used for selective internal radiotherapy for liver metastasis of colorectal cancer in the world up to now. Over the past 20 years since its listing, yttrium [90Y] microsphere injection has been used to treat more than 120000 patients worldwide. Its safety and effectiveness have been widely recognized in clinical practice, and it has been recommended to treat colorectal cancer with liver metastasis by guidelines issued by many authoritative organizations.

In 2018, Yuanda Pharmaceutical, together with CDH, acquired Sirtex at a price of US $1.4 billion, and then introduced SIR Spheres yttrium [90Y] microsphere injection. In September 2021, with the assistance of Broad Pharmaceuticals, Sirtex successfully completed the first concession of SIR Spheres yttrium [90Y] microsphere injection for primary liver cancer indications in China, relying on the policy of "first trial" of overseas listed medical devices in Boao Lecheng International Tourism Medical Pilot Zone, Hainan Free Trade Port.

Source: reference 3

This approval not only makes up for the blank of local treatment for liver metastasis of colorectal cancer, but also marks that the field of liver cancer in China has ushered in a new international precision interventional treatment scheme, and also ends the era of duopoly in China's nuclear drug market, ushering in a competitive pattern of "tripartite confrontation".

Since 2018, Yuanda Pharmaceutical has gradually built an international first-class nuclear medicine diagnosis and treatment platform in the field of anti-tumor through Sirtex, Telix and ITM of Germany, and has achieved a full industrial chain in the global nuclear medicine field, including an all-round layout in research and development, production, sales, regulatory qualifications and other fields.

Before that, China Tongfu and Dongcheng Pharmaceutical had long occupied the leading position in the domestic nuclear drug market, with a large number of approved products and a large market share.

In the foreseeable future, China's nuclear medicine field is becoming more and more popular.

The moat that has been constantly built

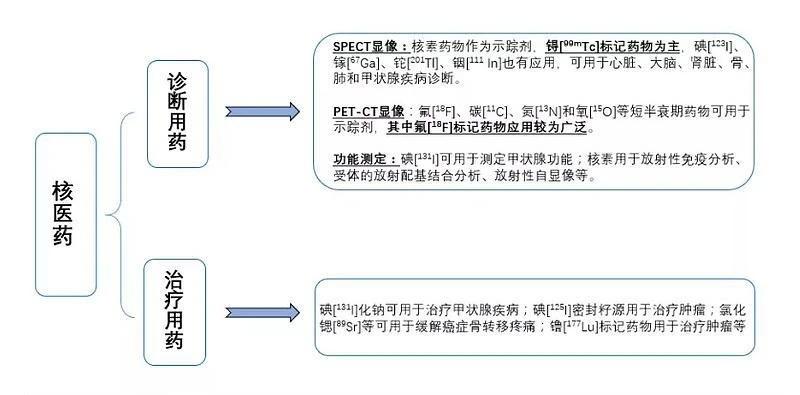

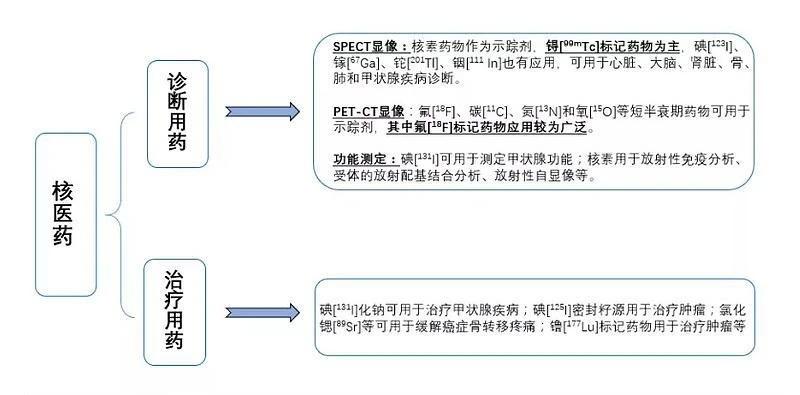

Nuclear medicine, that is, special drugs containing radionuclides used in nuclear medicine for diagnosis and treatment, is also known as radiopharmaceuticals. Radiopharmaceuticals are also divided into diagnostic radiopharmaceuticals and therapeutic radiopharmaceuticals according to whether they are used in diagnostic or therapeutic nuclear medicine.

Diagnostic nuclear medicine is used to obtain diagnostic information according to the distribution of drugs in organs and the difference between time and radioactive changes by using the radioactive drug tracing principle after entering the body through oral, inhalation or injection. It mainly includes fluorine (18F) marker (for PET-CT), technetium (99mTc) marker (for SPECT), etc.

Nuclear medicine for treatment means that it can be highly selectively concentrated in the diseased tissues, produce local ionizing radiation biological effects, inhibit or destroy the diseased tissues, and thus play a therapeutic role. It is mainly used for bone pain caused by tumors, hyperthyroidism, rheumatoid arthritis, tumor bone metastasis, etc., including iodine (131I and 125I) markers, lutetium (177Lu) markers, etc.

Source: Kaiyuan Securities Research News

Whether diagnosis or treatment, the main principle of nuclear medicine is related to the radioactivity of drugs. Today's radionuclides are mainly produced by reactors and accelerators, and some can be obtained by radionuclide generators and nuclear fuel reprocessing.

Therefore, nuclear raw materials are generally managed by the state, and access to nuclear raw materials requires a high level of production and management. Therefore, the nuclear medicine field has the characteristics of "double high", that is, high barriers to entry and high industry concentration.

According to the existing data, in 2018, China's nuclear medicine market will be about 5 billion yuan, expected to reach 11 billion yuan by 2022, with a compound annual growth rate of 20%.

Among them, according to the 2020 annual report, the revenue of China's nuclear medicine with the same radiation is 2.97 billion yuan, accounting for about 40% of the market; The nuclear drug revenue of Dongcheng Pharmaceutical was 930 million yuan, accounting for about 20% of the market.

China Tongfu has subsidiaries such as Atomic High Tech, Atomic Science and Technology, China Nuclear Qualcomm, Ningbo Jun'an, and China Nuclear Hydway. The market share of many products is the first in China. The market share of iodine [131I] sodium chloride oral solution and strontium chloride [89Sr] injection exceeds 90%; Fluoride [18F] deoxyglucose injection exceeds 80%; Technetium [99mTc] labeled injection exceeds 70%.

In 2015, Dongcheng Pharmaceutical acquired Yunke Pharmaceutical, Shanghai Xinke, Yitai Pharmaceutical and Andico successively, entering the field of nuclear medicine with high technical barriers and high profitability. After mergers and acquisitions in recent years, a therapeutic radiopharmaceutical production platform represented by Yunke Pharmaceutical, a radiopharmaceutical research and development platform represented by Shanghai Yitai, a radiopharmaceutical real-time labeling and distribution platform represented by Dongcheng Xinke, and a positron pharmaceutical production and distribution platform represented by Nanjing Andico have been preliminarily formed.

While grabbing market share, the duopoly is constantly building a moat.

Because the half-life of radionuclides must be considered for nuclear drugs, some nuclear drugs with short half-life (e.g., the half-life of 18F is 109.8 minutes, and the half-life of 99mTc is 6.01 hours) cannot be stored after mass production like ordinary drugs and then transported to medical institutions for sale over a long distance. Therefore, the production site of nuclear drugs with short half-life must be close to medical institutions for immediate production, distribution and use as required.

Therefore, nuclear pharmacy has become the key to build a moat for nuclear medicine manufacturing enterprises.

The construction standard of nuclear pharmacy is strict, and the approval cycle is long, requiring about 50 million yuan. It is understood that it takes one and a half years for the environmental assessment and construction of nuclear pharmacy, and one and a half years for obtaining the certificate, with strong barriers. China Tongfu has 17 nuclear pharmacies, dominated by technetium standards, 8 fluorine standards, and Dongcheng Pharmaceutical has 14 nuclear pharmacies, all of which are technetium standards. Both nuclear pharmacies are still being expanded substantially.

Not only that, China Tongfu and Dongcheng Pharmaceutical are embarking on the integration between nuclear pharmacies and strategic positioning. At the same time, the two sides are also realizing the sharing of resources, channels and products among their different enterprises. If short half-life radionuclide drugs want to enter the Chinese market in the future, they must rely on the domestic nuclear pharmacy network for production and sales. Once the integration is completed, the market position of the duopoly will be more stable.

Innovation in progress

The overseas nuclear drug market started early. In 1951, the FDA approved the first nuclear drug iodine [131I] and listed it as a drug for thyroid patients. Now, many nuclear drug leading enterprises such as Novartis, GE, Cardinal Health, UPPI, RadioMedix, Lantheus, etc. have been born in the world. The US FDA has approved more than 50 nuclear drugs. The prostate cancer treatment drug Xofigo, radiolabeled somatostatin analog Lutathera, etc. are global nuclear drug star products.

However, the research and development of innovative nuclear drugs in China has almost stagnated over the years, and no innovative nuclear drugs have been approved in recent years.

The problems lie in many aspects. At the regulatory level, there are problems such as the regulatory system is not in line with international standards and cannot adapt to the characteristics of radioactive drugs. According to the regulations issued in previous years, the experimental phase in the drug registration process is required to be completed in the GLP laboratory. At the same time, radioactive drugs must conform to the radiation safety supervision system. But for many years, China has no laboratory that can handle radioactive materials and has GLP qualification, which affects the R&D and application of new radiopharmaceuticals.

The good news is that since 2021, with the continuous promotion of the policy spring breeze, the nuclear medicine industry has pressed the fast forward button.

In June 2021, the National Atomic Energy Agency, the Ministry of Science and Technology and other eight ministries and commissions jointly issued the Medium and Long term Development Plan for Medical Isotopes (2021-2035), which is the first programmatic document issued for the application of nuclear technology in medical and health fields in China. It pointed out that by 2025, a number of key core technologies for the development of medical isotopes had made breakthroughs, and the construction of 1-2 special production reactors for medical isotopes had been started in due time, Stable and independent supply of commonly used medical isotopes; By 2035, actively promote the "going global" of medical isotopes.

Source: reference 6

Based on the needs of the market and policy support, relevant enterprises are speeding up the research and development of nuclear drug innovation.

At present, China Tongfu has 7 kinds of radiopharmaceuticals for imaging diagnosis and treatment under research, including two radiopharmaceuticals in clinical trials (131I-MIBG injection, sodium fluoride [18F] injection), one kind of radiopharmaceuticals for treatment to be approved for clinical trials (palladium [103Pd] sealed seed source), and four radiopharmaceuticals for imaging diagnosis and treatment in various research and development stages.

The main R&D products under the platform of Dongcheng Pharmaceutical include [188Re] - HEDP injection, which is mainly used for the analgesic treatment of bone metastasis of malignant tumors, and is currently in Phase IIb clinical trial; Fluoride [18F] sodium chloride injection is a bone scanning imaging agent for the diagnosis of bone metastasis of malignant tumors. At present, the preliminary preparation for clinical trials has been completed; Yttrium 90 resin microspheres are undergoing preclinical biological evaluation such as pharmacological efficacy, pharmacokinetics and safety.

The above mentioned radioactive drug diagnosis and treatment platform, which is the key layout of Yuanda Pharmaceutical, now has 10 global innovative products, including yttrium [90Y] microsphere injection and the remaining 9 RDC drugs, including 6 kinds of nuclides, including 68Ga, 177Lu, 131I, 90Y, 89Zr, 99mTc, and the indications cover liver cancer, prostate cancer, clear cell renal cell cancer, glioblastoma, gastrointestinal pancreatic neuroendocrine tumor, and bone metastasis of malignant tumors.

Among them, the RDC drug TLX591 CDx used to diagnose prostate cancer has been approved for marketing in the United States and Australia, and has obtained special authorization in Brazil to be sold before being officially approved; TLX250 CDx, which is used to diagnose clear cell renal cell carcinoma, has been approved by FDA as a breakthrough therapy, and the first patient in Phase I clinical study was administered in Australia; TLX101 for the treatment of glioblastoma has been recognized as an orphan drug by FDA.

With the relaxation of policies, the increase of capital, the increase of talents, and the acceleration of domestic substitution, China's nuclear drug development situation is continuing to improve.

Epilogue

Unlike competitors in other industries, there is close cooperation between participants in China's nuclear medicine field. However, such close cooperation also makes the latecomers unprofitable, which seems to be detrimental to the development of the industry to some extent. With the progress of technology, the nuclear medicine related diagnosis and treatment business has become increasingly complex, involving increasing varieties and dosage. At present, there are obvious deficiencies in the supply of nuclear drugs in China. Accelerating innovation and involving more willing enterprises is the key to solving the contradiction. Pharmaceutical Intelligence Network will continue to pay attention to the future development.

Reference material

Announcement and official website of Yuanda Pharmaceutical, China Tongfu, Dongcheng Pharmaceutical

"The duopoly pattern of nuclear medicine is about to loosen, and innovative nuclear medicine for treatment becomes the key to breaking the situation?", China Nuclear Technology Network, January 27, 2022

Grand Pharma Nuclear Drug Raceway's blockbuster product was approved, filling the gap in clinical treatment of liver cancer in China, Gazelle, February 10, 2022

"Foreign giants vie for the layout of nuclear medicine, but" Dongcheng Pharmaceutical "has been far ahead of the giants", an analysis of the snowball column on investment in APP, November 7, 2019

"A Day Up Nearly 20%, Nuclear Drug Oligopoly China Tongfu (01,763) Wants to" Return to A ", Zhitong Finance and Economics, February 1, 2021

The First National Medical Isotope Development Plan Release, CNNC, June 24, 2021

From: tencent News Client

Statement: this article is a reprinted content, and the copyright belongs to the original author. The purpose of reprinting is to convey more information, which does not represent our views. If you have any questions about the content, copyright and other issues, please contact us, and we will delete the content at a time.

86-0510-88786189

86-0510-88786189